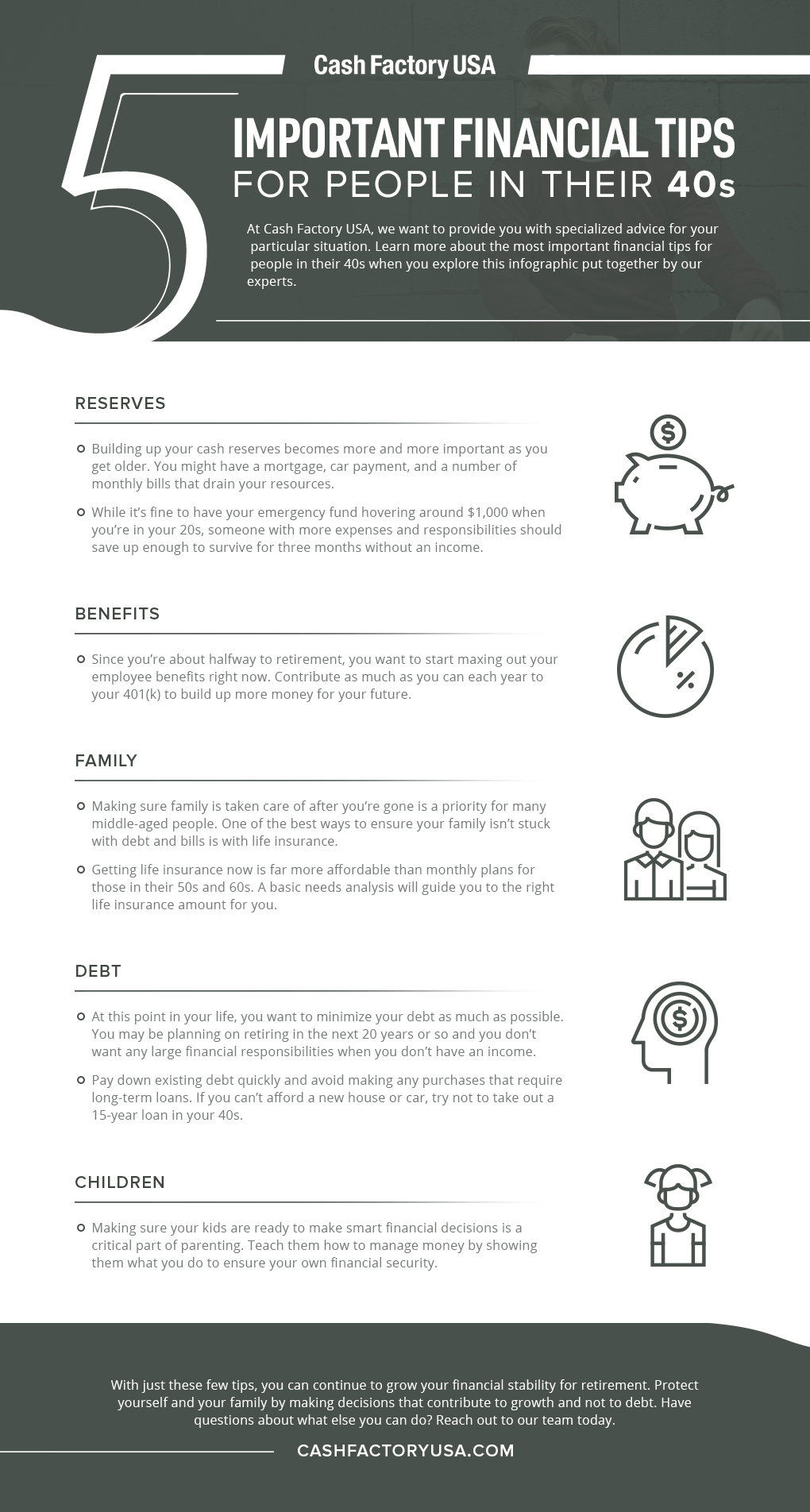

As someone in their 40s, there are many possibilities for where you could be in your life. You could be new parents or you could have just sent your children off to college. Some people in their 40s are even considering early retirement in the next decade. Since there are so many different variables here, the financial tips for your generation are very broad. Explore some financial literacy tips from Cash Factory USA here.

1. Build Your Reserves

At this point in your life, your emergency fund should be pretty big. A good rule of thumb here is to ensure you have three to six months of salary in an account that’s liquid and easily accessible. This financial tip ensures you’re prepared for an expensive health diagnosis, unexpected financial downfalls, and even trouble your children got into.

Many people in their 40s could find themselves getting laid off, so having enough to live through finding another job is crucial.

2. Max Out Employee Benefits

While every employer has different benefits, one of the most common is a 401(k). Our financial tip is to invest the maximum you can in this account since your employer is matching every cent you put in. It was all right to contribute minimal amounts to this account in your 20s, but you’re heading towards the end of your working years and you want to build this fund up as much as possible. It will be your financial stability for the future.

3. Insure Your Family

Looking at life insurance in your 40s is a relatively inexpensive proposition and could save you thousands of dollars. If you wait until your 50s or 60s to get a life insurance plan, you’ll be paying much more. A good financial tip is to consider the needs of your beneficiaries before choosing a plan.

A basic needs analysis will look at ongoing and future expenses including medical bills, funeral costs, and debt accumulation that your children could be saddled with after you pass.

4. Eliminate Debt

Going into retirement with debt is a big no-no. You should be at the end of repaying your student debt and your budgeting apps should have been helping you maintain low expenses. You want to be as debt-free as possible to ensure the best possible credit ratings and allow you to save even more money for retirement.

Many people in their 40s still have extensive financial commitments from their mortgage or helping their children attend college. Pay down your debt quickly to avoid accumulating interest and defaulting on payments.

5. Prepare Your Children

Whether they’re 15 or 25, your kids need to be prepared to make their own smart financial decisions. As you get older, they could be increasingly responsible for caring for their own finances as well as yours. Give them financial tips to ensure they know how to do their taxes, how to budget, and how to invest. Teaching them now will make them more capable later.

At Cash Factory USA, we want to help you make the right decisions for a healthy financial future. Prepare yourself with our financial literacy tips when you explore all our blogs here.