Did you know the average household in the United States owes over $100,000 in combined student loans, mortgages, credit card debts, and more.* With numbers like this, it’s no surprise that millions of people in America stress about money. But what may come as a surprise is that many people actually may use debt to work towards their goals. Debt can come in many different forms, from buying a home to investing in education, and can be either “good” or “bad”. And it’s important to understand the difference between the two. So, in this guide, we’ll explore what good debt and bad debt are. We’ll also share some tips for how you can manage yours.

What’s the Difference Between “Good” and “Bad” Debt?

The main difference between good debt and bad debt is whether it increases your net worth or has any future value. If it does, then it may be good for some people. So, while being cautious about money could help you make better financial decisions, it’s important to remember that not all debts may be bad. Some debts can even be beneficial to your credit history and help you reach your financial goals.

Examples of Good Debt

One of the most popular forms of good debt is a mortgage, because it can allow you to build wealth over time. Why is a mortgage considered a good debt and not bad debt? Since the 1960s, home prices have rose 2.4 times faster than inflation, according to a recent study.* This is because housing is something that will always be in demand, although through the years there have been supply issues. And basic economics tells us that when you have high demand, but low supply, the cost is driven up. So, while a mortgage is technically considered a debt, it has the potential to make you money in the long run, making it “good”.

Other examples that are generally considered good could include:

- Student Loans: Taking out student loans to invest in your education may lead to higher earning potential and career opportunities.

- Mortgages: A mortgage allows you to purchase a home, which could appreciate in value over time, building equity.

- Business Loans: Borrowing money to start or expand a business may lead to increased income and financial stability.

Benefits of Good Debt

When managed properly, good debts can offer several benefits that may positively impact your financial situation. Some of the key benefits may include:

- Asset Creation: Good debts could help you gain assets that can increase in value over time. These could include a home or an education. These assets may potentially create wealth and improve your financial standing.

- Investment in Future Earning Potential: Taking on debt to invest in education or training could lead to higher earning potential and better career opportunities in the future.

- Tax Benefits: In some cases, the interest paid on certain good debts, such as a mortgage, may be tax-deductible. This could reduce your overall tax obligation, but always consult a tax expert for more details.

- Building Credit: Managing good debts responsibly can typically help you build a positive credit history. This can be important for future borrowing needs, such as buying a car or a home.

- Leverage for Investments: Good debt could give you leverage for investments that have the potential to create returns that exceed the cost of the debt. This could include starting a business or investing in real estate.

- Financial Flexibility: Access to good debt can provide financial flexibility in times of need, such as for unexpected expenses or emergencies.

Overall, good debt, for some, can be a valuable tool for achieving financial goals and building wealth when used wisely and managed responsibly.

Examples of Bad Debt

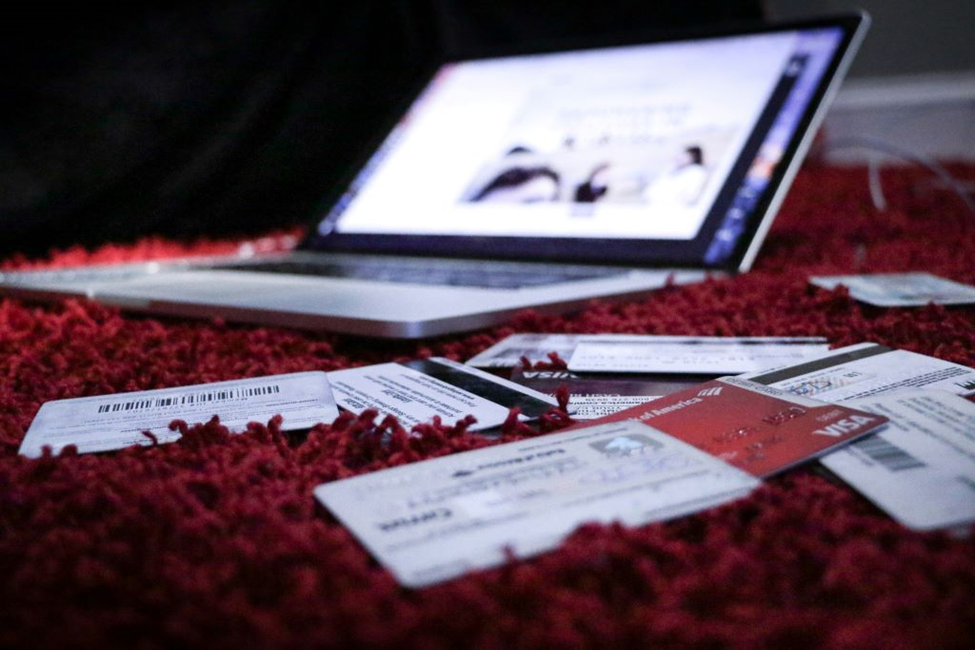

Bad debt, on the other hand, typically may not increase your net worth or improve your financial situation. It often comes with high interest rates and could lead to financial stress. Some of life’s basic necessities — from clothes and cars to televisions and computers — may be considered bad. So if you can’t pay cash for them, you may want to reconsider buying them.

Credit card debt can be easy to get into and difficult to get out of. Plus, with steep interest rates, they could be dangerous for some. You might be paying 3-5% on a mortgage or student loan, but credit cards can have interest rates that range from 13% to as much as 23%. These numbers aren’t set in stone and can change depending on your credit score and perceived reliability. Regardless of your interest rate, credit cards and debt are linked. This is because just one late payment may negatively impact your finances.

Examples that are generally considered bad could include:

- Credit Cards: Using credit cards to pay for a lifestyle beyond your means can lead to high-interest payments and long-term debt.

- Cash Advance Loans: These short-term loans may come with extremely high interest rates. You should use them for short-term financial needs only, as they can be expensive and are not suitable for long-term solutions.

- Auto Loans for Luxury Cars: While a car loan may be necessary, financing an expensive luxury vehicle can be considered bad debt. This is because cars depreciate in value over time.

Is Bad Debt Really That Bad?

Just because credit cards can lead to bad debt doesn’t mean you should never have one. It’s just important to repay your debts with high interest on time. Some other examples of debts that can turn bad if you don’t repay them on time could include:

- Auto repayment loans

- Cash advance loans

- Installment loans

How Much Debt is Too Much?

Consider carefully tracking your debt-to-income ratio to make sure you’re not straining your finances and hurting your credit score. Try comparing your net income with your monthly bills to make sure you aren’t spending over 45% on your debts. These should include mortgage payments, car payments, credit card purchases, and other major bills.

The reason spending too much on paying off your debts could be trouble is because it can look bad to potential lenders. They may see you as an unreliable borrower, with so many other debts fighting for your attention. Having too many debts, even if they are all considered “good,” could still be a problem.

Tips for How to Get Out of Debt

- Differentiate Between Needs and Wants: Before taking on debt, ask yourself if the purchase is a necessity or a luxury. Focus on meeting needs rather than giving in to your wants.

- Create a Budget: Create a budget that includes your income, expenses, and debt repayment. Stick to this budget to avoid building up more money you’ll have to pay back.

- Pay More Than the Minimum: If you have high-interest debt, such as credit cards, try to pay more than the minimum payment each month. This can help you reduce the principal balance faster.

- Consolidate Debt: Consider consolidating high-interest debts into a single, lower-interest loan. This can make repayment more manageable.

- Build an Emergency Fund: Having an emergency fund can help you avoid going into debt for unexpected expenses, such as car repairs or medical bills.

- Seek Professional Advice: If you’re struggling with debt, consider seeking advice from a financial advisor or credit counselor. They can help you create a plan to manage and reduce the amount you owe.

Not All Debt is Bad

Knowing more about good debt vs. bad debt can help you make the best financial decisions for you and your family. By managing debt wisely and focusing on investments that increase your net worth, you may be able to achieve financial stability.

*High-interest loans can be expensive and should be used only for short-term financial needs, not long-term solutions. Customers with credit difficulties should seek credit counseling. The opinions expressed above are solely the author’s views and may or may not reflect the opinions and beliefs of the website or its affiliates. Cash Factory USA does not provide financial advice.

This blog contains links to other third-party websites that are not endorsed by, directly affiliated with, or sponsored by Cash Factory USA. Such links are only for the convenience of the reader, user, or browser.